proposed estate tax law changes

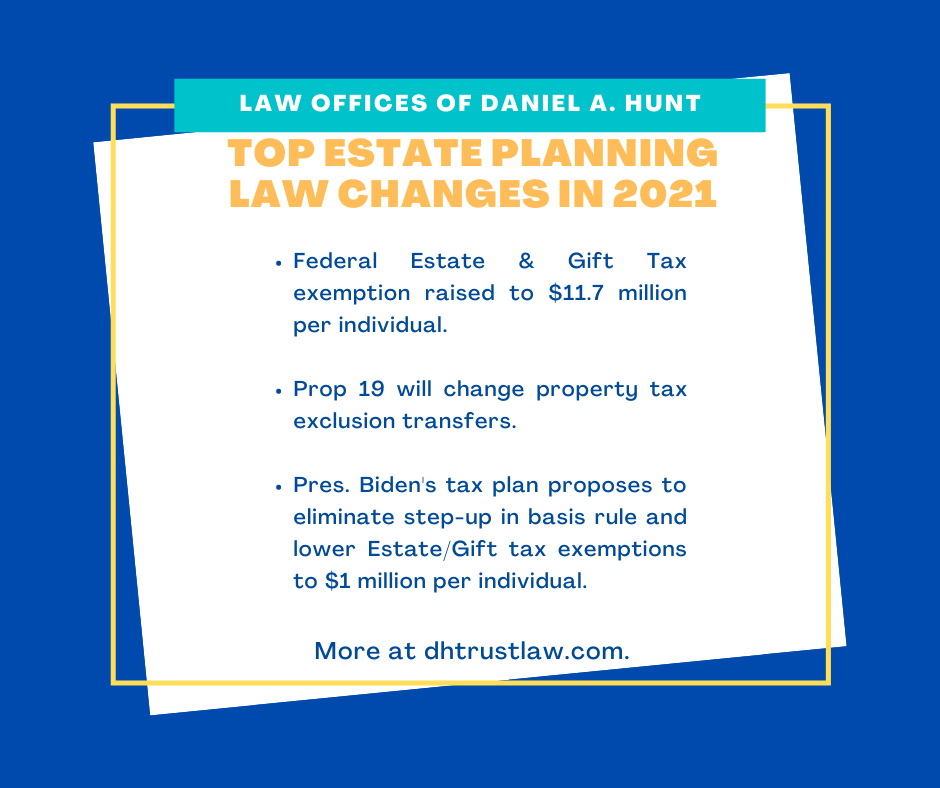

Estate and Gift Tax Exclusion Amount. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Estate Tax Law Changes Could Have Costly Implications Uhy

Effective January 1 2022 the federal estate and gift tax exclusion will be cut in half to about 60 million after adjustment for inflation.

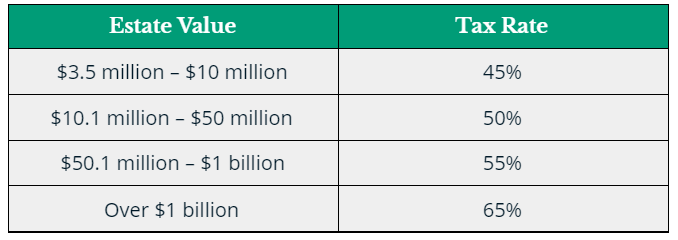

. Estates valued over 35 million but less than 10 million would be subject to an estate tax. The Property Tax Assistance Division provides a Handbook of Texas Property Tax Rules PDFFor up-to-date versions of rules please see the Texas Administrative Code. Some of the more important proposals.

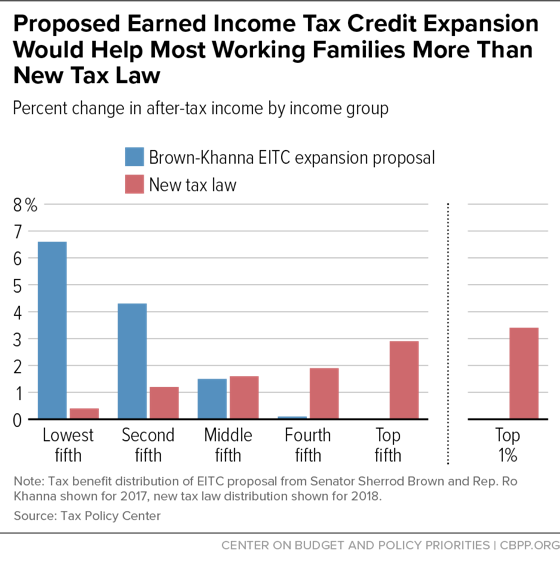

The top four areas to watch are the federal. House and Senate Democrats are working with the Biden administration to pass legislation to fund their infrastructure initiatives including. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

November 5 2021 in Uncategorized by Karen Dzierzynski. Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted upwards each year for inflation in 2026. The proposed changes are so drastic and impactful on estate planning and probate that you need to know what is out there.

Two potential laws also need to be planned for said Gassman. July 13 2021. Under present law inherited property receives a full fair market.

That same estate would result in a taxable estate of about. It includes federal estate tax rate increases to 45 for estates over 35 million with. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Reduction of the estate tax exemption amount to 35 million per person 7 million for a married couple with the exemption being indexed for inflation. The For the 995 Percent Act proposes a sliding scale for rates as follows. The 995 Percent Act would make significant and direct changes to the estate gift and generation skipping transfer GST tax rules.

Proposed Changes under Biden Administration. An estate of 11700000 per person 23400000 per couple would result in no tax under current law before 2026. To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law changes.

Reduce the current 11700000 per person gift and estate tax exemption the unified exemption by approximately one half. One of the biggest changes the President hopes to make would be tax on death. That is only four years away and.

The current 2021 gift and estate tax exemption is 117 million for each US. Repeal of step-up in basis. Estate and Gift Tax Changes.

Bernie Sanders and the White House formally proposed a bill called. The Biden campaign proposed to reduce the Estate Tax exemption amount to 35 million per person and to increase the top. The Biden Administration has proposed significant changes to the.

Proposed Estate Tax Law Changes.

Reviving Estate Tax Rules Gives Opening To Take Aim At The Rich

New Tax Law Is Fundamentally Flawed And Will Require Basic Restructuring Center On Budget And Policy Priorities

Estate Planning And Potential Tax Law Changes Vanilla

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

How Proposed Tax Law Changes Will Disrupt The Real Estate Industry Wiss Company Llp

How Changes In Tax Laws Impact Your Estate Plan Snyder Law

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner

2021 Proposed Tax Law Changes Potential Impacts

Alert Proposed Changes In Estate Tax Laws Connecticut Estate Planning Attorneys Blog

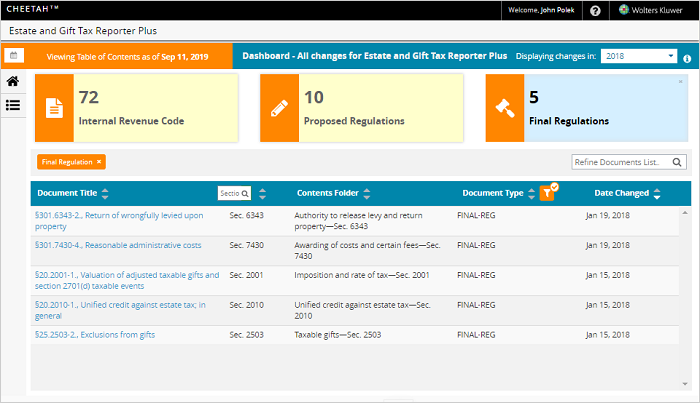

Estates Gifts And Trusts Tax Law Suite Wolters Kluwer

Estate Tax Current Law 2026 Biden Tax Proposal

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Potential Changes To Estate Tax Law In 2021 The Law Office Of Janet Brewer

2021 Proposed Tax Law Changes Potential Impacts

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

Tax And Estate Law Changes Financial Harvest Wealth Advisors

Potential Tax Law Changes Impacting Estate Planning Fredrikson Byron Fredrikson Byron P A

Worth It Insights On Wealth Management And Personal Planning Strategies